NSN 1560-01-439-8598 212030164215, 212-030-164-215, 01-439-8598

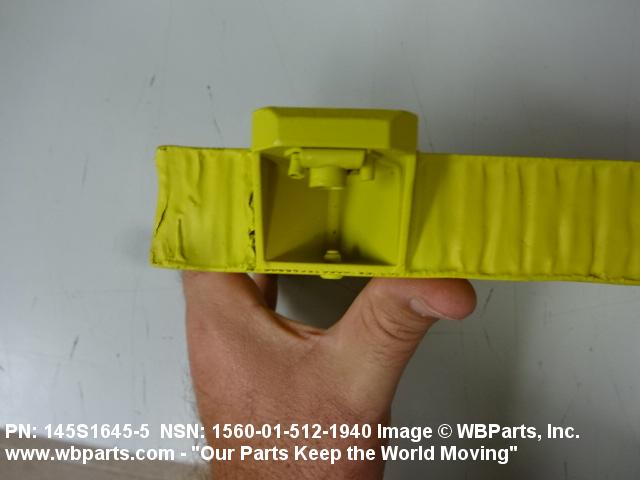

Product Details | AIRCRAFT STRUCTURAL COMPONENT SUPPORT

1560-01-439-8598 A device of various shapes to be permanently attached to the structure of an aircraft. It is designed to permanently mount and/or support an integral member, or group of members of the airframe in a proper position and bear the stress imposed by the components being supported. It may have mounting provisions, such as slots, holes, and/or attachments to facilitate installation. Excludes items which are primarily designed for dampening shock and/or vibration. Excludes BRACKET, ANGLE; BRACKET, DOUBLE ANGLE; BRACKET, SHELF; BRACKET, MOUNTING; BRACKET (1), STRUCTURAL COMPONENT, AIRCRAFT; and RADIUS BLOCK.

Part Alternates: 212030164215, 212-030-164-215, 1560-01-439-8598, 01-439-8598, 1560014398598, 014398598

Aircraft and Airframe Structural Components | Airframe Structural Components

| Supply Group (FSG) | NSN Assign. | NIIN | Item Name Code (INC) |

|---|---|---|---|

| 15 | 20 DEC 1996 | 01-439-8598 | 32243 ( SUPPORT, STRUCTURAL COMPONENT, AIRCRAFT ) |

Cross Reference | NSN 1560-01-439-8598

| Part Number | Cage Code | Manufacturer |

|---|---|---|

| 212-030-164-215 | 97499 | BELL HELICOPTER TEXTRON INC. |

Request a Quote

What Our Customers Say

Compare

Related Products | NSN 1560-01-439-8598

Restrictions/Controls & Freight Information | NSN 1560-01-439-8598

| Category | Code | Description |

|---|---|---|

| Hazardous Material Indicator Code | P | There is no information in the HMIS; however, the NSN is in an FSC in Table II of Federal Standard 313 and an MSDS may be required by the user. The requirement for an MSDS is dependent on a hazard determination of the supplier or the intended end use of the product |

| Demilitarization Code: | A | Non-Munitions List Item/ Non-Strategic List Item - Demilitarization not required. |

| Electro-static Discharge Susceptible: | A | No known Electrostatic Discharge (ESD) or Electromagnetic Interference (EMI) sensitivity |

| Precious Metals Indicator Code: | A | Item does not contain precious metal |

| Automatic Data Processing Equipment: | 0 | Represents items with no ADP components. NOTE: Codes 1 through 6 are only to be used when the item is Automatic Data Processing Equipment (ADPE) in its entirety and is limited to the type meeting only one of the definitions for codes 1 through 6. (See code 9) |

| Category | Code | Description |

|---|---|---|

| No Freight Information | ||