NSN 4140-01-611-7614 FNA1500 , 01-611-7614, 016117614

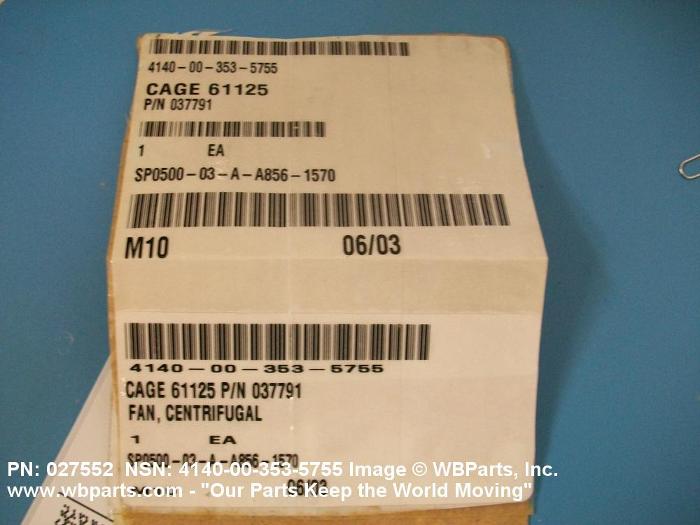

Product Details | CENTRIFUGAL FAN

4140-01-611-7614 A nonpositive displacement mechanical device having a centrifugal fan impeller inclosed within a housing. It is designed to move air or gas over a wide range of volumes and pressures. The air or gas is drawn in axially and discharged radially or drawn in radially and discharged axially by centrifugal force through an outlet in the housing.20216600062Aircraft Air Conditioning, Heating, and Pressurizing Equipment41400043Fans, Air Circulators, and Blower Equipment

Part Alternates: FNA1500 , 4140-01-611-7614, 01-611-7614, 4140016117614, 016117614

Refrigeration, Air Conditioning, and Air Circulating Equipment | Fans, Air Circulators, and Blower Equipment

| Supply Group (FSG) | NSN Assign. | NIIN | Item Name Code (INC) |

|---|---|---|---|

| 41 | 2012269 | 01-611-7614 | 04254 ( FAN, CENTRIFUGAL ) |

Cross Reference | NSN 4140-01-611-7614

| Part Number | Cage Code | Manufacturer |

|---|---|---|

| FNA1500 | 1U2V5 | SEABOTIX, INC. |

Request a Quote

What Our Customers Say

Compare

NSNs for Compare ( up to 4 ): Add 4140-01-611-7614

Related Products | NSN 4140-01-611-7614

Technical Data | NSN 4140-01-611-7614

| Characteristic | Specifications |

|---|---|

| III PART NAME ASSIGNED BY CONTROLLING AGENCY | FAN, CENTRIFUGAL |

Restrictions/Controls & Freight Information | NSN 4140-01-611-7614

| Category | Code | Description |

|---|---|---|

| Hazardous Material Indicator Code | N | There is no data in the HMIS and the NSN is in an FSC not generally suspected of containing hazardous materials |

| Demilitarization Code: | A | Non-Munitions List Item/ Non-Strategic List Item - Demilitarization not required. |

| Precious Metals Indicator Code: | A | Item does not contain precious metal |

| Criticality Code: | X | The item does not have a nuclear hardened feature or any other critical feature such as tolerance, fit restriction or application. |

| Automatic Data Processing Equipment: | 0 | Represents items with no ADP components. NOTE: Codes 1 through 6 are only to be used when the item is Automatic Data Processing Equipment (ADPE) in its entirety and is limited to the type meeting only one of the definitions for codes 1 through 6. (See code 9) |

| Category | Code | Description |

|---|---|---|

| No Freight Information | ||